- info@ficci.org.bd

- |

- +880248814801, +880248814802

- Contact Us

- |

- Become a Member

- |

- |

- |

- |

- |

Commercial Bank of Ceylon PLC (CBC) has adopted sustainability as a core part, enriching its logo with a green border. This straightforward modification underscores the bank's dedication to green and sustainable banking. The bank showed firm commitment to sustainability by securing the coveted 'Excellent Green Commitment Award' for the Banking Sector in 2019 from the Green Building Council of Sri Lanka (GBCSL). Furthermore, CBC has achieved triple honors including two Golds, at the Green Industry Awards 2024 organized by the Industrial Development Board (IDB). As Sri Lanka's first 100% carbon-neutral bank, it received the award for 'Low carbon and/or climate-resilient production' and 'Green digital and information technologies' for its contribution towards environmental sustainability and digital banking adoption.

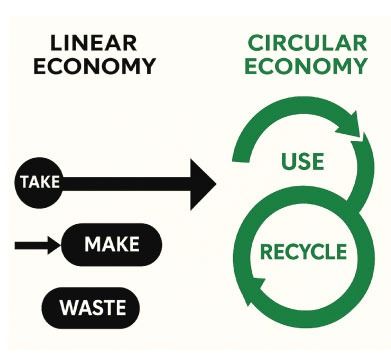

The circular economy represents a shift in how we conceptualize and use resources. It entails a shift from the linear "take, make, waste" framework to one that is regenerative by design-where plastics and other materials get recycled and reused, and water is treated as a common, scarce resource. The circular economic model is in fact one of the core pillars of the European Union's EU 2020 strategy. And from an economic point of view, the transition offers strong economic and investment opportunities. The Ellen MacArthur Foundation estimated that circular economy practices can yield $4.5 trillion of economic benefits to the world by 2030. Sustainable Development Goals (SDGs) has a holistic approach by minimizing waste and pollution, promoting resource efficiency, and supporting a transition to renewable energy. Bangladesh Bank (BB) supports the transition to a circular economy through its Sustainable Finance initiatives, including green banking and the Green Transformation Fund. In fact, transition to a circular economy, waste prevention and recycling is one of the main objectives of Sustainable Finance Policy for Banks and Fls, published by Bangladesh Bank.

Commercial Bank of Ceylon PLC has embedded circular economy principles into its operations, reinforcing its commitment to sustainable banking and environmental responsibility. The Bank has developed its own Sustainability Guidelines and established a comprehensive Environmental and Social Management System (ESMS) framework. CBC has introduced over sixty sustainable products and initiatives, including support for plastic waste recycling plants processing PVC (Polyvinyl Chloride), PP (Polypropylene), LDPE (Low-Density Polyethylene), HDPE (High-Density Polyethylene), marine plastic pollution reduction, and water consumption management, among others.

The World Bank Group (2022) reported that around 646 tons of plastic wastes are collected daily in Dhaka, and only 37.2% is recycled whereas globally, less than 10% of plastic waste is recycled. CBC has made an investment in the sector where plastic granules are manufactured from wastage plastic. CBC actively engages communities in carrying out effective recycling and waste minimization programs. Over the past couple of years, the bank supported programs such as the establishment of recycling centers, educational campaigns, and promoting upcycling projects both in Head Office and Bangladesh Operations. These initiatives not only minimize waste but also create new income-generating opportunities for the participants, which align with circular economy objectives. As the global economy transitions to sustainable models, water management becomes a key pillar in the circular economy.

As the global economy transitions towards sustainable models, water management stands out as a vital pillar in the circular economy. For banks, especially in regions facing water stress, supporting efficient and regenerative water use is not just a matter of corporate social responsibility-it's a strategic investment in resilience, climate action, and long-term economic stability. CBC continues to demonstrate its commitment to environmental sustainability through targeted CSR initiatives addressing water challenges in vulnerable communities. In coastal and agricultural regions affected by salinity intrusion, CBC has supported the installation of drinking water plant to promote safe water reuse and reduce freshwater extraction. CBC also supported to establish Effluent Treatment Plant (ETP) to help removing harmful contaminants from industrial wastewater, ensuring that water is treated.

Zero Liquid Discharge (ZLD): Financing the Future of Circular Water Economy - A Role for Banks

As climate change intensifies water scarcity, governments and industries are facing mounting pressure to adopt sustainable water management. One cutting-edge solution that is picking up steam is Zero Liquid Discharge (ZLD) a treatment process that enables no industrial wastewater to be released into the environment. Rather, all the wastewater is treated and recycled, directly contributing to the ideas of the circular economy. Industries such as textiles, pharmaceuticals, chemicals, and power generation are increasingly adopting ZLD to realize sustainability ambitions and regulatory compliance. For banks, ZLD is a unique opportunity to align financial portfolios with environmental goals while unlocking new opportunities for sustainable investments. The banks can extend green finance or sustainability-linked finance facilities for funding the installation of ZLD systems. These financing arrangements can include attractive features such as lower interest rates, performance-based incentives, repayment holiday during project commissioning etc. The Bank can also structure lease-financing solutions in collaboration with Zero Liquid Discharge (ZLD) technology providers, offering an alternative to traditional loans. This "Water-as-a-Service" model enables industries to adopt advanced water treatment systems without upfront capital investment, instead paying through the operational savings generated over the system's lifecycle. Additionally, the Bank can partner with green venture capital firms or impact investors to support start-ups and technology innovators developing affordable, modular ZLD solutions tailored for SMEs and rural industries.