- info@ficci.org.bd

- |

- +880248814801, +880248814802

- Contact Us

- |

- Become a Member

- |

- |

- |

- |

- |

1.0 Trade and investment are powering Bangladesh's Development Trajectory

The country has successfully leveraged global demand, particularly in manufacturing sectors, to generate employment and stimulate economic growth. Integration into global value chains (GVCs) has played a pivotal role in this transformation. However, providing decent employment opportunities for a growing labor force and a large informal sector remains a persistent challenge. To sustain its growth trajectory, Bangladesh must deepen its integration into the global economy valued at over $33 trillion exports as a strategic driver of GDP growth and job creation.

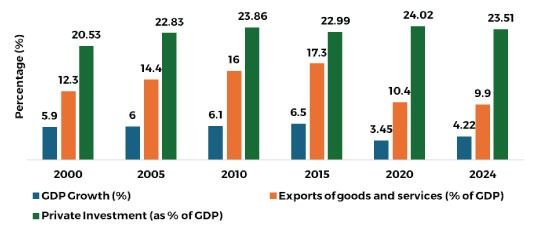

Figure 1: Private Investment, GDP Growth and Exports in the Last Decade

Source: Bangladesh Bank, World Bank, BBS

Simultaneously, private investment has been a central engine of Bangladesh's economic transformation. Accounting for approximately 76% of total investment2, the private sector has propelled structural diversification-from an agrarian base to a more industrialized and service-oriented economy. Between 2000 and 2024, private investment increased from 20.53% to 23.51% of GDP, contributing significantly to GDP growth, employment, and exports3. Notably, exports peaked at 17.3% of GDP in 2015, while GDP growth remained resilient despite both global and domestic headwinds.

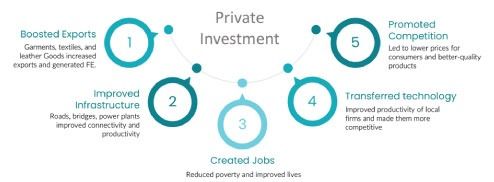

Figure 2: How Private Investment in Bangladesh Helped Stimulate Economic Growth

Private sector-led activities particularly in labor-intensive industries such as ready-made garments (RMG), construction, real estate, ICT, and SMEs-have been vital for employment generation in both urban and rural contexts. These investments have created direct jobs in manufacturing and infrastructure, as well as indirect employment through logistics, retail, transport, and other services.

However, recent trends indicate a gradual decline in private investment, falling from 24.52% of GDP in 2022 to 23.51% in 2024. This drop reflects persistent constraints including foreign currency shortages, high inflation, sluggish global demand and social turmoil. Despite these challenges, private investment continues to be a cornerstone of Bangladesh's economic progress, and unlocking its full potential will be essential for ensuring long-term growth, competitiveness, and inclusive development.

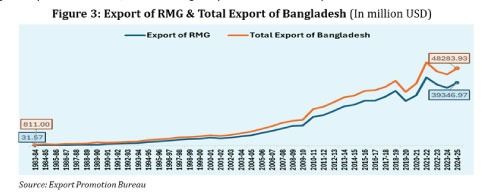

2.0 Overdependence on RMG: An Undiversified Export Base

Bangladesh's export structure remains heavily concentrated in a single sector-ready-made garments (RMG) which accounted for over 81.4% of total exports in FY2024-25. This overwhelming reliance on one industry exposes the economy to considerable external risks, including global demand fluctuations, shifts in buyer compliance standards, and increasing competition from low-cost producers.

Although the RMG sector has historically driven export earnings, employment, and foreign exchange, its dominance has created structural fragility. Bangladesh has made only modest gains in diversifying into sectors such as leather, agro-processing, pharmaceuticals, and electronics-none of which yet account for a significant share of export earnings. With LDC graduation expected in 2026, and the subsequent loss of preferential market access, the urgency to diversify into higher-value, innovation-driven exports have never been greater.

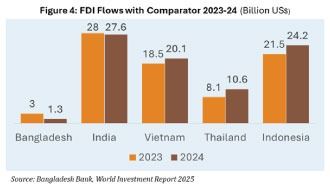

Low FDI: Undermining the Push for Export Diversification

Bangladesh's export base remains narrowly concentrated; its foreign direct investment (FDI) landscape also reflects significant underutilization. FDI is crucial for export diversification, industrial upgrading, and technology transfer fell sharply from $3 billion in 2023 to $1.3 billion in 2024. In contrast, Vietnam drew $20.1 billion, Indonesia $24.2 billion, and India nearly $28 billion.

However, attracting such investment will require overcoming persistent confidence continues to be hampered by policy and regulatory bottlenecks, infrastructure deficits, and foreign exchange and profit repatriation concerns. These constraints deter long-term, productivity-enhancing capital and limit Bangladesh's ability to diversify beyond RMG. As a result, the country faces a double vulnerability: heavy reliance on a single export sector, and insufficient FDI to build alternatives.

However, attracting such investment will require overcoming persistent confidence continues to be hampered by policy and regulatory bottlenecks, infrastructure deficits, and foreign exchange and profit repatriation concerns. These constraints deter long-term, productivity-enhancing capital and limit Bangladesh's ability to diversify beyond RMG. As a result, the country faces a double vulnerability: heavy reliance on a single export sector, and insufficient FDI to build alternatives.

3.0 Why Trade and Investment Are Critical for Bangladesh's Future Aspirations

Bangla desh has rapidly emerged as one of South Asia's most promising economies, with a GDP of nearly $450 billion and projections exceeding $750 billion by 2029. Bangladesh'sstrategic location, strong manufacturing base, growing consumer class of over 34 million, and a young workforce 22 years younger than Japan's and 12 years younger than China's make it increasingly attractive to global investors. To reach high-income status by 2041, Bangladesh must boost trade and private investment. This includes doubling its export-to-GDP ratio from 11% to over 25%, requiring 8-10% annual export growth in more diverse, higher-value-added sectors.

desh has rapidly emerged as one of South Asia's most promising economies, with a GDP of nearly $450 billion and projections exceeding $750 billion by 2029. Bangladesh'sstrategic location, strong manufacturing base, growing consumer class of over 34 million, and a young workforce 22 years younger than Japan's and 12 years younger than China's make it increasingly attractive to global investors. To reach high-income status by 2041, Bangladesh must boost trade and private investment. This includes doubling its export-to-GDP ratio from 11% to over 25%, requiring 8-10% annual export growth in more diverse, higher-value-added sectors.

Foreign direct investment (FDI) will be critical to this transition. Beyond capital inflow, FDI facilitates technology transfer, innovation, integration into global value chains (GVCs), and improved market access is all essential for developing new comparative advantages beyond RMG. It also boosts domestic industries, spurs entrepreneurship, and creates jobs key to sustainable development. With LDC graduation nearing, Bangladesh must deepen regional and bilateral trade ties, enhance regulatory predictability, and align incentives with green and digital priorities. Positioning as a "China+1" alternative in sectors like electronics, agro-processing, textiles, and pharma is vital.

Foreign direct investment (FDI) will be critical to this transition. Beyond capital inflow, FDI facilitates technology transfer, innovation, integration into global value chains (GVCs), and improved market access is all essential for developing new comparative advantages beyond RMG. It also boosts domestic industries, spurs entrepreneurship, and creates jobs key to sustainable development. With LDC graduation nearing, Bangladesh must deepen regional and bilateral trade ties, enhance regulatory predictability, and align incentives with green and digital priorities. Positioning as a "China+1" alternative in sectors like electronics, agro-processing, textiles, and pharma is vital.

4.0 Trade and Investment Climate in Bangladesh Underpinned by Low Competitiveness

Bangladesh's trade and investment climate reflects a paradox of promise and persistent structural constraints. While the country has made notable economic strides in recent decades, its global rankings on competitiveness and innovation continue to reveal deep-rooted challenges that hinder private sector confidence and foreign investment inflows.

Bangladesh ranks 106th out of 133 in the Global Innovation Index 2024, far behind India (39th) and Vietnam (44th), with weak performance in human capital, business sophistication, and institutional quality. Despite moderate scores in infrastructure, creative output, and market sophistication, its innovation capacity remains below the lower-middle-income average. Similarly, the GCI places Bangladesh 105th out of 141, with a stagnant score of 52.1 and declining performance in areas like ICT adoption, labor efficiency, and infrastructure. The country also ranks low in skills (94th globally) and lags in Total Factor Productivity growth just 0.72 from 1970 to 2022, compared to 2.14 for India and 1.17 for Vietnam highlighting persistent structural and institutional weaknesses.

According to the Bangladesh Business Climate Index (BBX) 2023-24, the country recorded a score of 58.75, indicating a difficult operating landscape for businesses. Key issues identified include pressure

from tax authorities, inefficient revenue collection, inflationary pressures, and global uncertainties, including the ongoing Russia-Ukraine conflict. These challenges create unpredictability for investors and impose a heavy compliance burden on enterprises, especially small and medium-sized firms.

Despite Bangladesh's strategic location, demographic dividend, and recent economic momentum, the country's weak competitiveness, low innovation capacity, and institutional bottlenecks remain serious impediments to realizing its trade and investment potential. To compete effectively with regional peers and transition into a more diversified, resilient, and high-value economy, Bangladesh will need to under- take bold structural reforms that strengthen human capital, improve infrastructure, and foster a more business-friendly regulatory environment.

Bangladesh's Performance in Global Trade a Persistent Lag

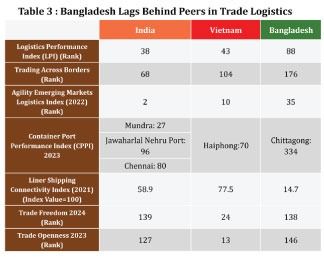

Bangladesh continues to face significant logistical and procedural challenges in international trade, as evidenced by its underperformance across multiple global indices. Comparative data with India and Vietnam shows that Bangladesh continues to lag across key trade competitiveness metrics. In the World Bank's LPI, Bangladesh ranks 88th far behind India (38th) and Vietnam (43rd) reflecting weak customs, infrastructure, and logistics systems. It also ranks 128th in the Economic Complexity Index, having declined over the past decade.

Bangladesh ranks 176th in the World Bank's "Trading Across Borders" metric, far behind Vietnam (104th) and India (68th), due to severe inefficiencies in customs, documentation, and clearanceprocesses. Exporting from Bangladesh takes 315 hours and costs USD 633-more than triple the time and double the cost in India. Import procedures are even more burdensome, undermining participation in global value chains, especially in time-sensitive sectors like electronics and pharmaceuticals.

Port inefficiencies further weaken Bangladesh's trade logistics performance. Chittagong Port ranks 334th in the 2023 Container Port Performance. Chittagong Port ranks 334th in the 2023 Container Port Performance Index, trailing far behind ports in Vietnam and India. Slow turn around, limited capacity, and weak global maritime links (Liner Shipping Connectivity Index: Bangladesh 14.7 vs.

Port inefficiencies further weaken Bangladesh's trade logistics performance. Chittagong Port ranks 334th in the 2023 Container Port Performance. Chittagong Port ranks 334th in the 2023 Container Port Performance Index, trailing far behind ports in Vietnam and India. Slow turn around, limited capacity, and weak global maritime links (Liner Shipping Connectivity Index: Bangladesh 14.7 vs.

Vietnam 77.5) increase shipping costs and delay exports. Trade policybarriers persist, with Bangladesh ranking 138th in the 2024 Index of Trade Freedom and 146th in the 2023 Trade Freedom 2024 Index of Trade Freedom and 146th in the 2023 Trade Openness Index, reflecting high tariffs, non-tariff barriers, and sluggish regulatory reform that deter both trade and investment.

Figure 8: Economic Complexity of Bangladesh and Vietnam Over the Years

Source: Atlas of Economic Complexity

Why Trade Matter More Than Ever for Bangladesh

1. Diversifying Exports Beyond RMG: RMG faces rising costs, protests, and LDC graduation risks. Diversifying into electronics, agro-processing, pharmaceuticals, and light engineering requires efficient logistics-roads, ports, multimodal hubs, and streamlined borders.

2. Lowering Trade Costs and Time: Efficient logistics cut business costs, enhance trade flow predictability, and boost price competitiveness. Reducing transport and customs delays is crucial for easing inflationary pressures on producers and consumers.

3. Boosting Regional and Transit Connectivity: Bangladesh's location offers transit potential with India, Bhutan, Nepal, and China. Upgraded land ports, digital customs, and regional corridors can expand trade, strengthen diplomacy, and increase revenue.

4. Attracting FDI through Better Logistics: Despite cost advantages, poor logistics deter FDI. Improved infrastructure, energy reliability, and regulatory reforms are vital to draw investment into SEZs and diversify beyond RMG.

5.0 Overarching Challenges for Trade and Investment in Bangladesh

Despite notable economic progress, Bangladesh continues to face deep-rooted structural and systemic barriers that constrain sustainable trade and investment growth. These challenges limit competitiveness, discourage foreign and domestic investment, and threaten long-term economic resilience especially as the country prepares for LDC graduation.

Figure 9: Overarching Challenge

Figure 10: Weak Governance and Economic Limitations Push Bangladesh Down in Transformation Index 2024

Source: Bertelsmann Stiftung's Transformation Index (BTI) 2024

6.0 Policy and Strategic Options for Integrated Approach towards Trade and Investment

To overcome persistent trade and investment barriers ranging from logistics inefficiencies and policy unpredictability to weak investor confidence Bangladesh must pursue a focused, actionable reform agenda.

Figure 11: Strategic Policy Priorities