- info@ficci.org.bd

- |

- +880248814801, +880248814802

- Contact Us

- |

- Become a Member

- |

- |

- |

- |

- |

1.0 Revenue, Debt, and Public Investment Management Emerging Priorities in Macro-fiscal Space

Bangladesh has long pursued an expansionary fiscal policy with a moderate budget deficit typically around 5% of GDP to support rapid economic growth, poverty reduction, and improved social outcomes 1. Despite achieving steady GDP growth over last three decades, critical challenges are emerging in maintaining macro-fiscal stability. These include a persistently low tax-to-GDP ratio, underdeveloped public investment management systems, and growing public debt pressures.

As the country aims to raise revenue to 11.2% of GDP and public expenditure to 16.2% of GDP by FY 2025-26, effective macro-fiscal management becomes more vital than ever 2. Three critical areas that underpin Bangladesh's macro-fiscal stability debt management, revenue mobilization, and public investment management highlighting the key challenges in each area and strategic recommendations for improvement.

2.0 Rising Debt and Shrinking Fiscal Space: Addressing Bangladesh's Mounting Risks

Bangladesh's rising debt levels since the Fiscal Year 2017 have emerged as a critical macro-fiscal concern, reflecting increased fiscal pressures and growing vulnerabilities.

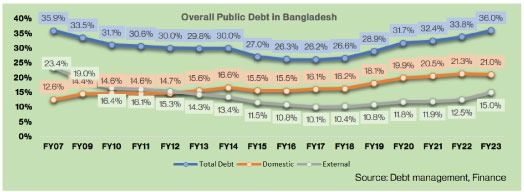

Figure 1: Trends in Overall Public Debt in Bangladesh

The country's total debt-to-GDP ratio climbed to 36.30% in FY2024 from 32.41% in FY2021, driven by substantial expansion in both domestic and external borrowing. External debt rose to BDT 8.12 trillion, pushing the external debt-to-GDP ratio to 22.60%, amid rising repayment obligations and declining foreign exchange reserves.

Alarmingly, the debt service-to-revenue ratio is projected to exceed 100%, indicating unsustainable debt dynamics and undermining fiscal space. In FY2025, 14.24% of the national budget is allocated solely for interest payments, severely limiting funds for development priorities. These trends point to an urgent need for robust debt management reforms including improved debt transparency, a strengthened Medium-Term Debt Strategy (MTDS), and prudent borrowing practices to ensure long-term fiscal sustainability and reduce the economic risks of excessive debt burden.

Figure 2: Commitment & Disbursement of Loans by Major Development Partners in FY24

2.1 Systemic Challenges in Bangladesh's Debt Management and Fiscal Oversight

Bangladesh's growing debt burden is compounded by several systemic and structural challenges that hinder effective and sustainable fiscal oversight:

• Fragmented Institutional Data: The absence of an integrated debt information system across institutions delays real-time access, weakening debt monitoring and timely decision-making.

• Underdeveloped Bond Market: With the bond market constituting only 21.3% of the financial sector, the country lacks diversified financing instruments beyond bank borrowing.

• Excessive Bank Dependence: The limited bond market compels the government to borrow primarily from the banking sector, creating risks of crowding out private investment and stressing the financial system.

• Foreign Exchange Vulnerabilities: Persistent depreciation of the Taka is escalating external debt servicing costs, intensifying fiscal pressures and increasing exposure to currency risks.

• Operational Inefficiencies: The lack of streamlined centralized data continues to hinder proactive debt management and strategic planning across government entities.

2.2 Key Considerations for Strengthening Debt Management

• Establish an Integrated Debt Data and Monitoring System

• Adopt and Operationalize a Comprehensive Medium-Term Debt Management Strategy (MTDS)

• Strengthen the Legal and Institutional Framework

• Develop the Domestic Bond Market and Diversify Financing Sources

• Enhance Risk Management Capacity and FX Resilience

3.0 Public Investment Management: Fiscal Efficiency Through Better Execution

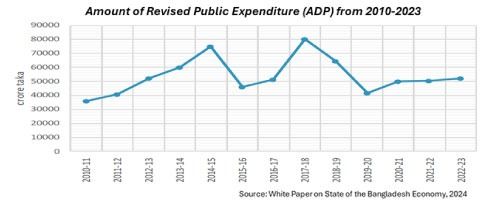

Public Investment Management (PIM) is a foundational element of the public financial management (PFM) system, guiding how governments plan, allocate, and execute development spending to maximize economic and social outcomes. In Bangladesh, PIM primarily operates through the Annual Development Program (ADP), alongside other channels such as public-private partnerships, climate fund initiatives, and operating budget programs. While the ADP has consistently accounted for about 30% of the total national budget over the past decade growing annually at 6.6% since 2010 the efficiency and effectiveness of public investment have remained suboptimal.

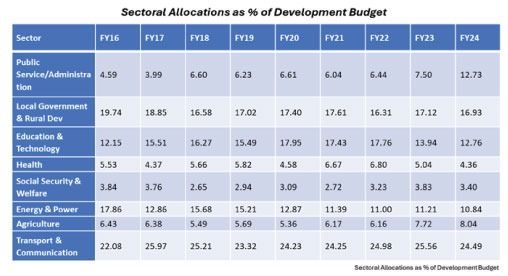

Figure 3: Amount of Revised Public Expenditure (ADP) from 2010-2023 Table 1: Sectoral Allocation as % of Development Budget

3.1 Key Challenges in Public Investment Management

• Fragmented Institutional Coordination: Overlapping mandates, weak inter-ministerial coordination, and irregular oversight lead to duplication, delays, and poor project alignment.

• Policy and Political Distortions: Lack of a PIM reform roadmap and political interference result in ad hoc project selection, ghost projects, and cost overruns.

• Outdated and Disconnected Systems: Absence of an integrated digital PIM platform, outdated tools, and poor data interoperability limit effective planning and monitoring.

• Capacity and HR Constraints: Shortage of skilled personnel and frequent turnover of project directors reduce implementation efficiency and oversight quality.

• Weak Appraisal and Monitoring: Poor logical frameworks, missing impact assessments, and limited post-project evaluations hinder accountability and learning.

3.2 Strengthening Public Investment Management for Stronger Fiscal Discipline

• Strategic Policy Reforms: Implement a comprehensive PIM reform roadmap with clear milestones, enhance institutional coordination, promote bottom-up project selection, and enforce transparent and criteria-based approval processes. Strengthen donor alignment and depoliticize project selection for better efficiency and accountability.

• Institutional Strengthening: Empower the PIM Reform Wing, reinforce the Planning Commission's appraisal capacity, and mandate ministerial vetting of projects. Improve inter-agency coordination and M&E systems and invest in specialized human resources to ensure sound project planning and execution.

3.2 Strengthening Public Investment Management for Stronger Fiscal Discipline

• Strategic Policy Reforms: Implement a comprehensive PIM reform roadmap with clear milestones, enhance institutional coordination, promote bottom-up project selection, and enforce transparent and criteria-based approval processes. Strengthen donor alignment and depoliticize project selection for better efficiency and accountability.

• Institutional Strengthening: Empower the PIM Reform Wing, reinforce the Planning Commission's appraisal capacity, and mandate ministerial vetting of projects. Improve inter-agency coordination and M&E systems and invest in specialized human resources to ensure sound project planning and execution.

• Technical System Upgrades: Upgrade and integrate digital systems (PPS, IMED, AMS), develop a unified PIM platform, and modernize software to cover full project lifecycle. Incorporate GPS, GIS, and real-time monitoring tools to enhance transparency and performance tracking.

• Climate and Risk-Responsive Planning: Strengthen and expand DRIP for national and sector-wide coverage, fully implement Green Climate & Resilience frameworks, and mainstream climate-risk assessments in planning. Ensure multi-year, risk-informed investment programming aligned with MTBF.

4.0 Domestic Revenue Mobilization: A Cornerstone of Macro-fiscal Stability

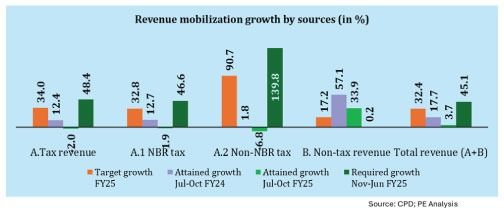

Effective revenue mobilization is central to ensuring macroeconomic stability, financing public services, and achieving sustainable development goals. However, Bangladesh consistently fails to meet its revenue targets, with tax revenue falling short by 2.0% and NBR tax by 1.9% in the first half of FY25far below the 34% growth required to meet the full-year target.

Figure 4: Revenue Mobilization Trends in Bangladesh

Figure 5: Revenue Mobilization Growth by Sources

This shortfall underscores persistent structural and institutional weaknesses in the tax system. The country's continued reliance on indirect taxes not only limits the revenue base but also imposes a disproportion- ate burden on lower-income groups, undermining equity and sustainability. Although recent reform initiatives, including the proposed bifurcation of the National Board of Revenue (NBR), aim to modernize tax policy and administration, concerns remain over the technical soundness, governance structure, and alignment with expert recommendations. Without resolving these core challenges particularly ensuring competent leadership and a stable reform framework for Bangladesh's risks compromising both its tax-to-GDP ratio and broader macro- fiscal resilience.

4.1 Structural Barriers Undermining Revenue Mobilization and Fiscal Credibility

• Fragmented Digital Systems and Limited Automation: Both income tax and VAT systems suffer from inadequate digital infrastructure, manual processes, and lack of skilled personnel. Minimal online filing, weak system integration, and outdated IT capacity hinder efficient tax administration and data-driven enforcement.

• Inaccurate Forecasting and Methodological Deficiencies: Revenue and macro-fiscal forecasts lack accuracy, transparency, and institutional scrutiny. MTMF projections are often based on unvalidated assumptions, with no structured evaluation or sensitivity analysis, reducing their reliability and planning utility.

• Inefficiencies in Legal and Administrative Frameworks: Lengthy litigation, overlapping procedures, and poor coordination across NBR units delay revenue collection. Complexity in VAT rates and paper-based systems further contribute to weak compliance monitoring and data disorganization.

• Low Taxpayer Compliance and Public Awareness: Complex tax processes, fear of harassment, and limited access to taxpayer services deter voluntary compliance. Poor awareness and education regarding VAT and income tax rules contribute to avoidance, particularly among small businesses and informal sectors.

• Weak Policy Design and Implementation Capacity: NBR's lack of structured research and training limits its ability to formulate and enforce responsive tax policies. Complexity in new VAT legislation and poor communication of policy changes hinder consistent and equitable application of tax laws.

• High Tax Expenditures and Poorly Targeted Incentives: Tax exemptions remain high and uncoordinated, estimated at over 3.5% of GDP, eroding the tax base. The absence of a strategic framework for tax incentives creates fiscal imbalances and reduces transparency and efficiency in revenue generation.

4.2 Recommendations for Strengthening Revenue Mobilization in Bangladesh

Enhancing domestic revenue mobilization is critical for financing Bangladesh's development priorities, reducing fiscal deficits, and ensuring economic resilience. To meet the ambitious FY25 targets and beyond, the govern- ment must adopt a comprehensive reform agenda combining political commitment, institutional reforms, and digital transformation.

• Enhance Political Commitment and Strategic Oversight: Establish a high-level Revenue Strategy Council to drive reforms, monitor NBR performance, and enforce accountability. Embed tax targets in high-level performance agreements and ensure regular reporting to Parliament.

• Broaden the Tax Base and Rationalize Exemptions: Conduct a comprehensive review of tax exemp- tions and remove outdated incentives. Bring under-taxed sectors (e.g., real estate, agriculture, and the informal economy) into the tax net through improved data sharing and compliance drives.

• Modernize Tax Administration and Strengthen NBR Capacity: Reorganize NBR into function-based units, upgrade human resources, and strengthen audit and enforcement functions. Establish dedicated research and policy units to support data-driven decision-making and realistic revenue forecasting.

• Accelerate Tax Digitization and Improve Compliance: Expand e-filing, e-payment, and real-time tracking systems using platforms like VAT Online and iBAS++. Use Al and data analytics for taxpayer risk profiling, detection of evasion, and improved enforcement.

• Improve Taxpayer Services and Public Trust: Establish one-stop taxpayer service centers, simplify procedures, and publish clear guidelines. Strengthen taxpayer grievance redress mechanisms and launch nationwide tax literacy campaigns to build compliance culture.