- info@ficci.org.bd

- |

- +880248814801, +880248814802

- Contact Us

- |

- Become a Member

- |

- |

- |

- |

- |

1. New Horizon Paves Way for Stronger Global Integration for Bangladesh

Bangladesh has entered a new dawn since the political changes in August last year. With significant political transformation underway, the country is expected to stride towards its aspirations for development, democratic principle, and good governance. As the interim government consolidates its agenda, the emphasis on governance reforms, economic liberalization, and citizen-centric policies is expected to play a crucial role in stabilizing the country and promoting sustainable development. This transition has given rise to opportunities for economic reforms and global engagement, particularly in attracting Foreign Direct Investment (FDI).

2. FDI Critical for Growth but Several Hurdles Limit Prospects

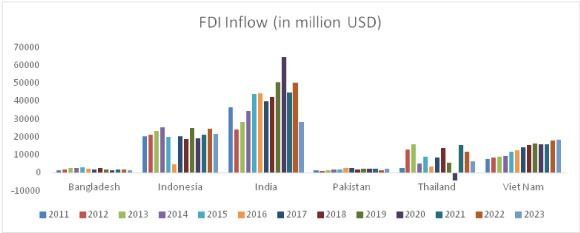

There is no doubt that FDI is an avenue for technology transfer, capital mobilization, market access, and job creation. Historically, FDI has significantly contributed to Bangladesh's growth and development, especially through successful collaboration with foreign partners in joint ventures and other corporate structures. It has played a pivotal role in advancing the Ready-Made Garments (RMG) sector, establishing Bangladesh as a global leader in the industry. Despite the success in the RMG sector, Bangladesh continues to trail its regional counterparts in attracting foreign investment. In 2023, Bangladesh secured only USD 3 billion in FDI which is significantly lower than Vietnam's USD 18.5 billion and India's USD 28.16 billion, reflecting a decline in competitiveness [1]. This figure also marks a drop from USD 3.4 billion in the previous year [2].

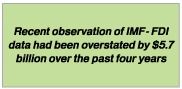

Additionally, the recent observation by IMF that FDI data had been overstated by $5.7 billion over the past four years will deepen the existing skepticism further, revealing an even lower actual FDI inflow[3]. At the same time, Bangladesh is in critical need to enhance its participation in global value chain, and diversification of its export products and markets. This situation highlights Bangladesh's imperatives to attract foreign investors and the urgent need for decisive action to restore confidence and enhance competitiveness.

Additionally, the recent observation by IMF that FDI data had been overstated by $5.7 billion over the past four years will deepen the existing skepticism further, revealing an even lower actual FDI inflow[3]. At the same time, Bangladesh is in critical need to enhance its participation in global value chain, and diversification of its export products and markets. This situation highlights Bangladesh's imperatives to attract foreign investors and the urgent need for decisive action to restore confidence and enhance competitiveness.

Figure 1: Bangladesh FDI Inflows (In Million USD)

Source: Foreign Direct Investment and External Debt, Bangladesh Bank

Figure 2: Bangladesh Lags Behind Comparator Countries in Attracting FDI

Source: World Bank

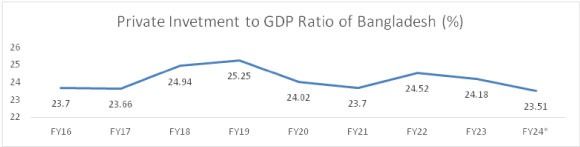

Figure 3: Stagnating Private Investment to GDP Ratio in Bangladesh

Source: National Accounts Statistics 2024, BBS

3. Efficient Port-led Connectivity Key to Unlock FDI and Exports Potential

Developing ports-led logistics infrastructure could be transformative in addressing these challenges by enhancing connectivity, reducing overall logistics costs and lead time, and creating an investor-friendly environment to attract higher levels of FDI. However, Bangladesh's current logistics infrastructure is under-developed and this will limit the industries and economy from reaching the full potential.

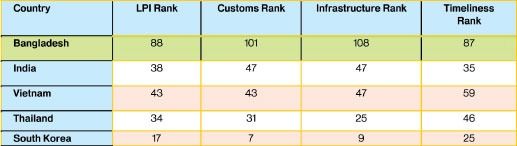

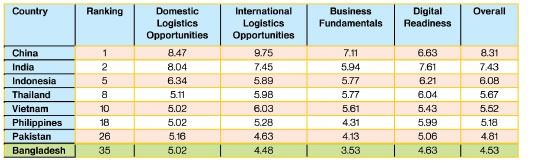

Table 1: Logistics Performance Index 2023

Source: The Logistics Performance Index and Its Indicators, 2023, World Bank

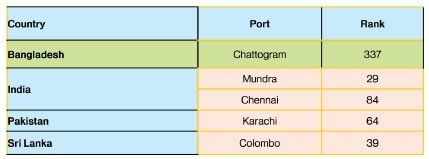

Table 2: The Container Port Performance Index 2023

Source: Container Port Performance Index 2023, World Bank

Chattogram Port, which handles over 90% of the nation's trade and about 98% of container trade, has been steadily increasing its capacity to handle cargo. The port is ranked 337th out of 405 in the World Bank's Contain- er Port Performance Index 2023[4]. According to the same report, ships face average turnaround times of 3.23 days at Chattogram, compared to Colombo which takes only 0.86 days[5]. Lastly, import clearance takes an average of 11 days, while export border compliance requires 36 hours[6]. While recent operations in Chattogram Port have shown improvements, there is still room to further increase efficiency in the port sector.

Table 3: Emerging Markets Index 2023

Source: Emerging Markets Index 2023, Agility

Any efficiency gains in the ports will be negated if bottlenecks in the broader logistics ecosystem are not removed. Road, rail, and inland waterway connectivity between ports and the cargo hinterlands remain inadequate, adding to transportation costs and delays. The recent launch of a National Single Window (NSW) system system is a step in the right direction, that will streamline regulatory process and improve efficiency, but it will take time for the full implementation to proceed and the benefits to take effect. These challenges, coupled with limited port capacity, prevent Bangladesh from capitalizing on its geographic advantage and robust manufacturing base. The cumulative inefficiencies indicate weak global competitiveness, higher business and trading costs, and trade delays that discourage investments and hinder economic growth.

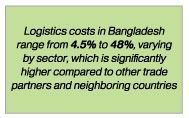

According to the World Bank, the logistics costs in Bangladesh range from 4.5% to 48%, varying by sector, which is significantly higher compared to other trade partners and neighboring countries[7]. The report suggests that national export earnings could increase by 19% with targeted short-term and medium-term reforms in the logistics sector. A 1% reduction in transportation/logistics costs could boost the demand for Bangladeshi exports by up to 7.4%[8]. It is widely recognized that a well-developed logistics system is crucial for expanding trade, diversifying exports, attracting both local and foreign investment, and achieving higher economic growth.

According to the World Bank, the logistics costs in Bangladesh range from 4.5% to 48%, varying by sector, which is significantly higher compared to other trade partners and neighboring countries[7]. The report suggests that national export earnings could increase by 19% with targeted short-term and medium-term reforms in the logistics sector. A 1% reduction in transportation/logistics costs could boost the demand for Bangladeshi exports by up to 7.4%[8]. It is widely recognized that a well-developed logistics system is crucial for expanding trade, diversifying exports, attracting both local and foreign investment, and achieving higher economic growth.

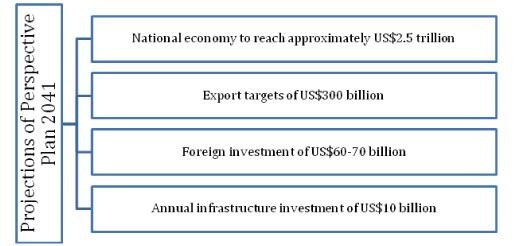

Moreover, the Bangladesh Perspective Plan projects the national economy to reach approximately US$2.5 trillion by 2041, with export targets of US$300 billion, foreign investment of US$60-70 billion, and annual infrastructure investment of US$10 billion[9]. Achieving these goals requires substantial investment in the logistics sector, which will serve as a key catalyst for growth.

Figure 5: Achieving the Goals of Perspective Plan 2041 Requires Significant Investment in the Logistics Sector

Some critical projects under planning, such as the Matarbari Deep Sea Port and the Bay Terminal in Chatto- gram, offer glimpses of hope. These initiatives promise to increase port capacity, reduce export lead times, and cut shipping costs by up to 15% [10]. For instance, the Bay Terminal is designed to handle larger vessels, potentially increasing total container handling capacity to over 6 million TEUS by 2036, up from the current 3.2 million TEUS. However, the success of these projects depends on swift completion of project preparations and roll out of the project implementation, as well as supporting infrastructure such as a breakwater and adequate dredging of the navigational channel, and complementary investments in hinterland connectivity, warehousing, and digitalization. Without these, the benefits of expanded port capacity will remain unrealized.

4. Global Best Practices: Lessons from Other Economies

Vietnam's integration of FDI into its logistics strategy has not only improved port efficiency but also facilitated export diversification. Similarly, Singapore's adoption of digital platforms, such as Port Community System, has streamlined customs processes and optimized trade flows. These cases underscore the importance of embracing technology, encouraging private sector participation, and ensuring a policy framework that attracts long-term investments.

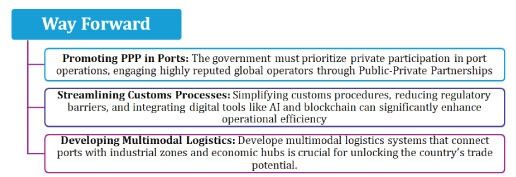

5. Key Policy Considerations for Better Port-led Connectivity

For Bangladesh, the path forward is clear. The government must prioritize private participation in port operations, engaging highly reputed global operators through Public-Private Partnerships to bring in expertise and technological advancements. This will also help mobilize foreign private capital at a time when government needs to minimise its public spending until fiscal discipline is restored. Simplifying customs procedures, reducing regulatory barriers, and integrating digital tools like Al and blockchain can significantly enhance operational efficiency. Moreover, developing multimodal logistics systems that connect ports with industrial zones and economic hubs is crucial for unlocking the country's trade potential.

Improving the logistics infrastructure is not merely a technical endeavor; it is a strategic imperative. The United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP) estimates that improved infrastructure could generate an additional $35.5 billion for Bangladesh by 2030. Such a transformation would not only enhance trade competitiveness but also position Bangladesh as a regional logistics hub, attracting high-value FDI and driving sustainable economic growth.

Figure 6: Strategic Gains from Reducing Logistics Costs and Enhancing Transport Efficiency [1] [2] [3]

As Bangladesh charts its course toward becoming a high-income country, the role of ports and logistics cannot be overstated. A modern, efficient, and transparent logistics system will act as a catalyst for growth, enabling the country to integrate seamlessly into global markets and attract the investments needed to build a resilient, competitive economy. The stakes are high, but the rewards are transformative. With bold reforms and strategic investments, Bangladesh can unlock its true potential, creating a future of prosperity and global prominence.

[1] World Investment Report 2024

[2] World Investment Report 2024

[3] FDI data overstated by $5.7b in four years, The Daily Star, 2024

[4] Container Port Performance Index 2023, World Bank

[5] Container Port Performance Index 2023, World Bank

[6] Container Port Performance Index 2023, World Bank

[7] National Logistics Policy 2024

[8] National Logistics Policy 2024

[9] National Logistics Policy 2024

[10] Matarbari A Future Commercial Hub of the Region, Chittagong Port Authority, 2020

1 Bangladesh can increase 20% export growth by cutting logistics costs: Experts, 2022, TBS

2 Logistics costs need to dramatically come down to meet post-LDC challenges, 2023, TBS

3 One day dwell-time reduction at Chittagong port to increase exports by over 7.0pc: WB official, 2021, The Financial Express